Whales Continue to Buy Despite High BTC Prices

Large Bitcoin investors , often referred to as “ whales ,” are maintaining their BTC accumulation trend despite the price hitting a new record high above $93,000 this year.

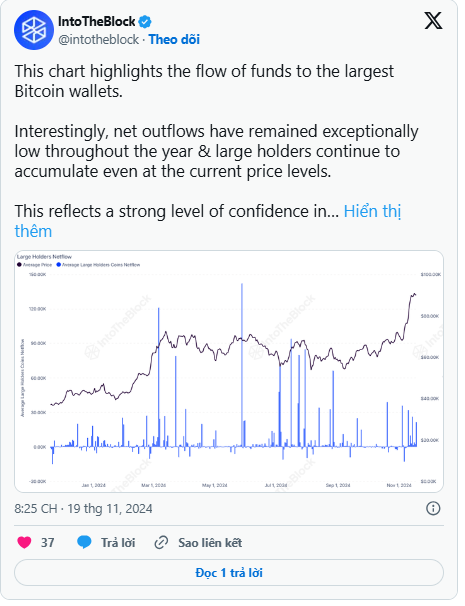

Long Term Accumulation Signal

According to data from on-chain analytics firm IntoTheBlock , outflows from the largest Bitcoin wallets remain low today, suggesting that large investors are placing strong faith in the cryptocurrency’s long-term potential.

This confidence comes in tandem with record capital flows into cryptocurrency investment products.

Last week, the market recorded an additional $2.2 billion , bringing the total value of assets under management of cryptocurrency investment funds to $138 billion , according to a report from CoinShares .

Goldman Sachs Increases Bitcoin ETF Purchases

Wall Street giant Goldman Sachs is also stepping up its investment in Bitcoin. According to a new filing with the US Securities and Exchange Commission (SEC) , the bank now holds $710 million worth of shares in major Bitcoin ETFs.

Of these, BlackRock's iShares Bitcoin Trust (IBIT) took the lion's share with $461 million , up 83% from the previous quarter.

Goldman Sachs also expanded its portfolio into funds like Fidelity's Wise Origin Bitcoin ETF (FBTC) , Grayscale Bitcoin Trust (GBTC), and Bitwise Bitcoin ETF (BITB) , which saw gains of 13% , 116% , and 156% , respectively .

Confidence in Bitcoin Is Reinforced

Analysts say the accumulation moves by “whales” and increased investment from large institutions like Goldman Sachs are positive signals for the Bitcoin market.

This not only reinforces confidence in the long-term potential of digital currencies, but also demonstrates the shift of traditional financial institutions into the crypto space.

In this context, retail investors need to be cautious, as market volatility is still possible as “whales” continue to dominate price trends.