Part 7: Staking Bitcoin là gì?

Staking typically involves holders locking up digital assets to participate in network activities, such as validating transactions on Proof of Stake (PoS) blockchains. While Bitcoin does not support direct staking due to its PoW mechanism, the emergence of platforms offering Bitcoin-based Liquid Staking tokens (LST) has opened up the possibility of indirect staking.

EigenLayer, Babylon and AVS

On the Ethereum network, the concept of “restaking” was introduced in 2023 with EigenLayer and gained significant traction in mid-2024, with total value locked (TVL) surpassing $20 billion. Staking ETH helps secure the Ethereum network and rewards participants. EigenLayer allows users to “restake” ETH to secure additional services and earn additional rewards.

Initially called Active Validated Services (AVS) on EigenLayer, these applications are now expanding to the Bitcoin blockchain, with Babylon leading the way in building an architecture that allows applications to leverage Bitcoin’s economic security. On Ethereum, protocols like Symbiotic and EigenLayer also accept tokens like Wrapped Bitcoin (WBTC) to enhance the security of applications.

Understanding Bitcoin Staking

In Bitcoin staking, users deposit BTC into the protocol and receive Liquid Staking tokens (LSTs) in return, representing the staked BTC. These LSTs typically provide greater liquidity and other functions, allowing participants to participate in DeFi without giving up staking rewards.

The most popular Bitcoin LST today is LBTC, issued from the Lombard protocol. Here's how LBTC works:

How to create LBTC : Users send BTC to special addresses associated with the Babylon protocol, thereby creating LBTC on Ethereum, which acts as a representation of the Bitcoin sent.

Where will the BTC go : The actual BTC is held in Babylon protocol contracts, which are safe but not used during this time.

Sender Rewards : During the time BTC is held, the sender receives rewards from both Babylon and Lombard to incentivize participation.

Future Plans : The goal is to use BTC in Babylon contracts to secure a larger ecosystem, allowing other applications and chains to use BTC for enhanced security.

Top Protocols in Bitcoin Staking

Some of the prominent protocols in the Bitcoin staking space include:

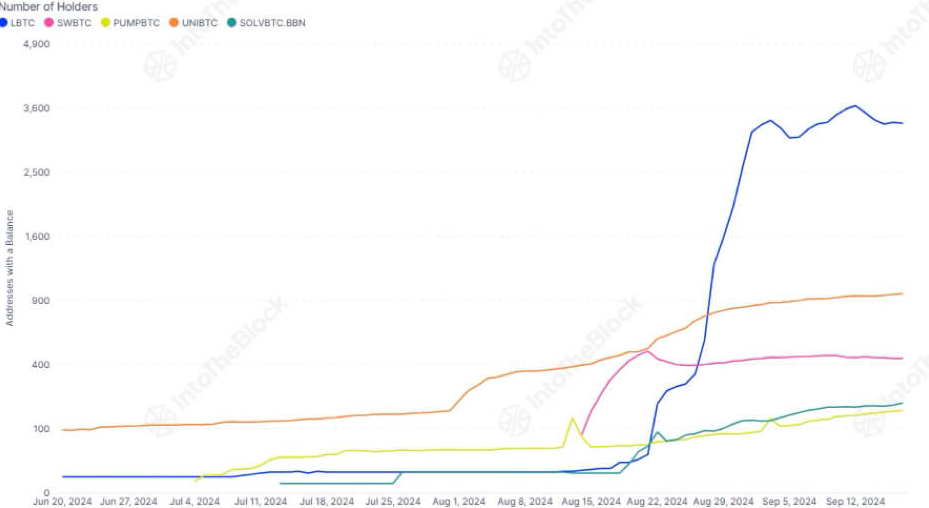

Lombard Staked BTC (LBTC) : Dominating the market with a $300 million capitalization and over 3,000 holders.

UniBTC : Gained a significant number of holders early on, currently around 1,000.

Swell BTC (SWBTC) : Started strong but has slowed down, currently ranked third with around 440 holders.

Is Bitcoin Staking the Future of Bitcoin Profits?

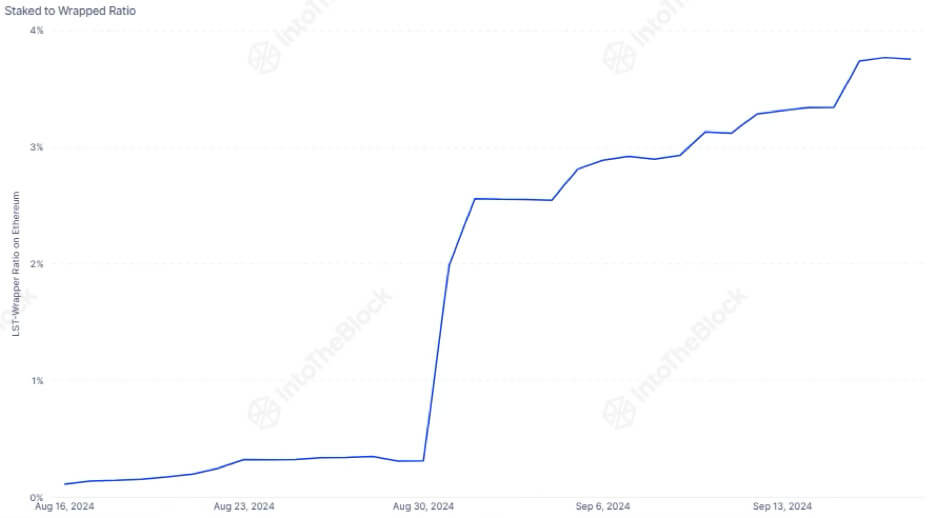

Bitcoin staking has had a strong start with thousands of holders participating. Currently, staked Bitcoin accounts for 3.75% of all Wrapped Bitcoin, showing potential for future growth.

The concept is promising, but long-term success will depend on the sustainability of the staking economics beyond the initial rewards. The development of services built on these protocols will determine whether Bitcoin staking can become one of the most attractive profit opportunities for Bitcoin holders.