Michael Saylor Praises Bitcoin as MicroStrategy Joins the “Magnificent 8”

MicroStrategy, known for its Bitcoin investment strategy , recently rose to the top spot on the US stock market, beating Amazon and Alphabet in daily trading volume for the first time.

With $5.5 billion in transactions on October 25, the company appears to have cemented its place in mainstream finance, joining what Executive Chairman Michael Saylor calls the “Magnificent 8.”

Michael Saylor – Executive Chairman of MicroStrategy

MicroStrategy Grows Financially Thanks to Bitcoin

Saylor celebrated MicroStrategy’s new status on X, while also emphasizing Bitcoin’s growing role in radically changing traditional market hierarchies.

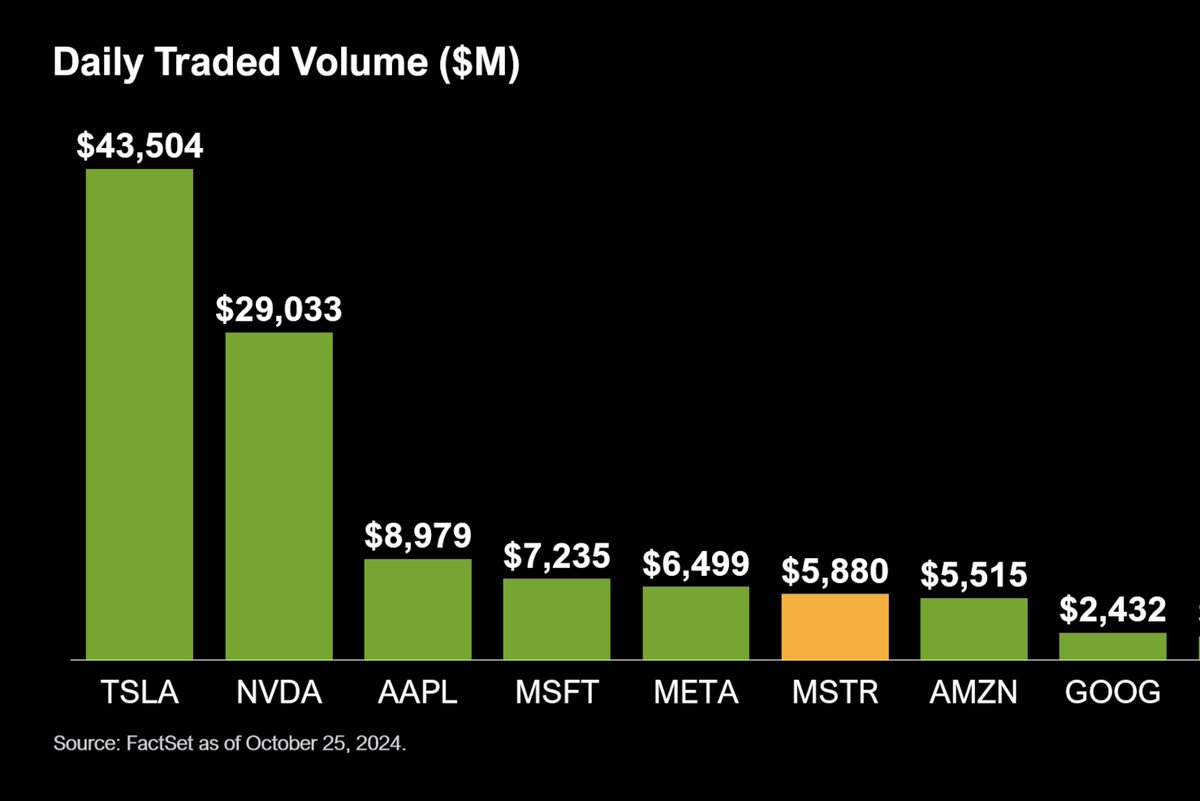

In his post , the BTC maximalist president shared graphics from FactSet showing his business intelligence platform surpassing tech giants Amazon and Google parent Alphabet in terms of daily trading volume.

Source: Michael Saylor

According to the data, more than $5.8 billion worth of MicroStrategy shares changed hands on October 25. Amazon had a slightly lower figure of $5.5 billion, while Alphabet had less than half of MicroStrategy's at $2.43 billion.

The company's financial situation has taken a big step forward thanks to its Bitcoin holdings, with a total of 252,220 BTC worth over $17 billion as of October 28.

The business analytics platform's stock price has soared 444% over the past year, including a 244% gain year-to-date, according to Yahoo Finance .

Furthermore, institutional confidence in the company was further bolstered when BlackRock, one of the world’s largest investment firms and also backing BTC via an ETF, increased its stake in MicroStrategy to 5.2%.

Saylor suggests Microsoft buy Bitcoin

Saylor recently advised Microsoft CEO Satya Nadella to consider integrating Bitcoin into the company’s business strategy, a proposal that Saylor described as a “trillion-dollar opportunity,” following news that the National Center for Public Policy Research is expected to propose an investment in the leading cryptocurrency by market capitalization at Microsoft’s upcoming annual shareholder meeting.

The research center noted that thanks to its BTC holdings, MicroStrategy's stock has outperformed Microsoft's stock by 313% over the past year, despite MicroStrategy representing only a small portion of Microsoft's business. However, Microsoft's board of directors has rejected the proposal, saying it is "unnecessary." They said they have "carefully" considered the issue and feel that the volatility of crypto is not suitable for corporate treasury applications.