Investors flee risk assets as JPMorgan raises recession odds to 40%

JPMorgan raises 2025 recession risk to 40%, Goldman Sachs raises forecast to 20% , warns it could be higher if the Trump administration maintains current policies.

Goldman Sachs raised the probability of a US recession to 20%, which could increase if the Trump administration keeps its policies in place. Morgan Stanley lowered its GDP growth forecast to 1.5% in 2025 and 1.2% in 2026, while raising its inflation expectations.

Still, White House economic adviser Kevin Hassett remains optimistic, saying the economy has many positives despite this quarter's unusual data.

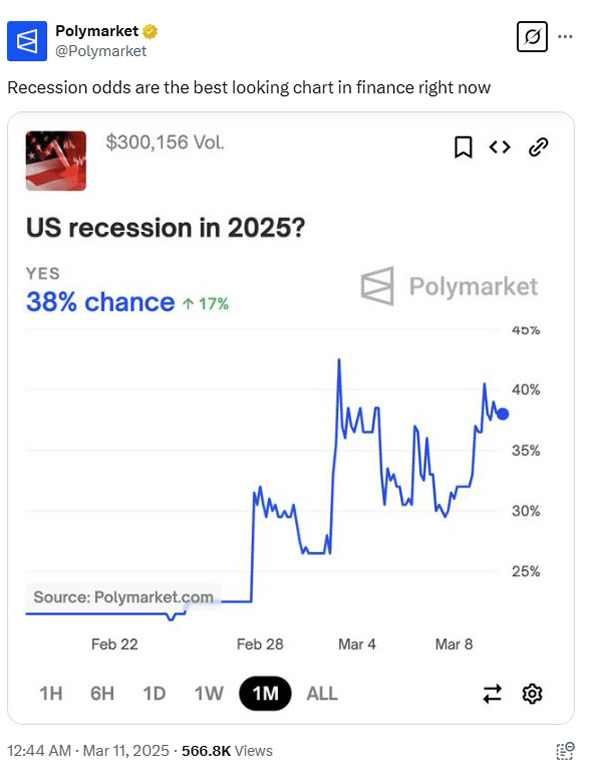

Trump called the US economy “in transition ” when asked about a recession. Polymarket humorously described the recession odds as “the most beautiful chart in finance right now.”

Tech and crypto stocks sell off

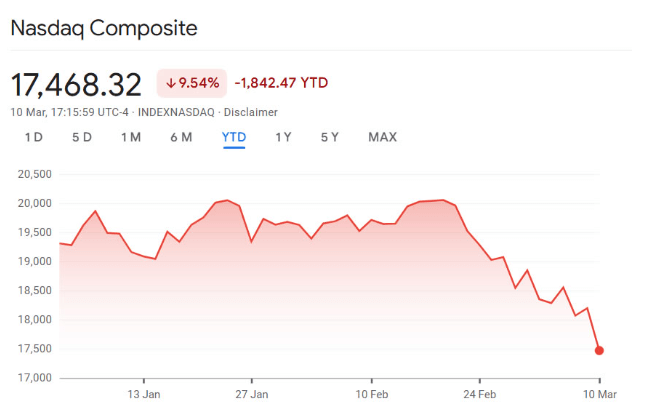

The “ Trump boost ” has evaporated as the S&P 500 has fallen below its pre-election level. The index has lost nearly 10% from its high last month, while the Nasdaq has entered a correction, down 14% in three weeks.

The US stock market was on fire on March 10: S&P 500 fell 2.7%, Nasdaq lost 4% - worst since 2022, Dow Jones fell 900 points. The "Magnificent 7" evaporated 750 billion USD in capitalization in one day, with Tesla down 15%, Nvidia down 5.1%, Apple 4.9%, Meta 4.4% and Alphabet 4.5%.