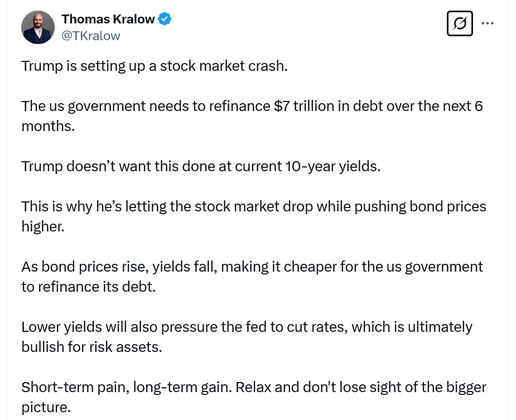

Did Trump intentionally crash the market to force the Fed to lower interest rates?

Commentator Anthony Pompliano suggested that the Trump administration may be deliberately destabilizing markets to force the Fed to lower interest rates to avoid refinancing its $7 trillion debt. He accused Trump and Treasury Secretary Scott Bessent of causing asset prices to plummet to put pressure on Jerome Powell .

The Fed refused to cut interest rates despite Trump's calls, keeping them at 4.25%-4.5%. Pompliano said Trump's tariffs caused market panic to boost bonds, causing the 10-year Treasury yield to fall from 4.8% to 4.21% , showing that Trump's strategy is working.

Whether Pompliano’s theory is correct or not, the stock market has been in a tailspin, with cryptocurrencies taking a bigger hit. The SPY index fell 2.66% and the Nasdaq-100 lost 3.8% on March 10 alone.

The stock and crypto markets continue to plummet, with the SPY down 7.32% and the Nasdaq-100 down 10.7% over the past month.

Bitcoin is down 27.4% from its all-time high, wiping out more than $1.2 trillion in cryptocurrency market capitalization. Pompliano said that if the decline continues, Trump and Powell will clash over interest rate policy, with Trump insisting that high interest rates hinder economic growth.

CME FedWatch sees a 96% chance that the Fed will keep rates at 4.25%-4.50% after its March 19 meeting, but a 50-50 chance of cutting rates on May 7. The Fed typically avoids cutting when inflation is high, but if a recession is triggered by Trump's policies, it could be forced to adjust.