BlackRock’s Bitcoin ETF Options Bring in Nearly $2 Billion in Trading on First Day

Options contracts on BlackRock ’s iShares Bitcoin Trust ( IBIT ) have hit record exposure, helping push the price of Bitcoin above $94,000.

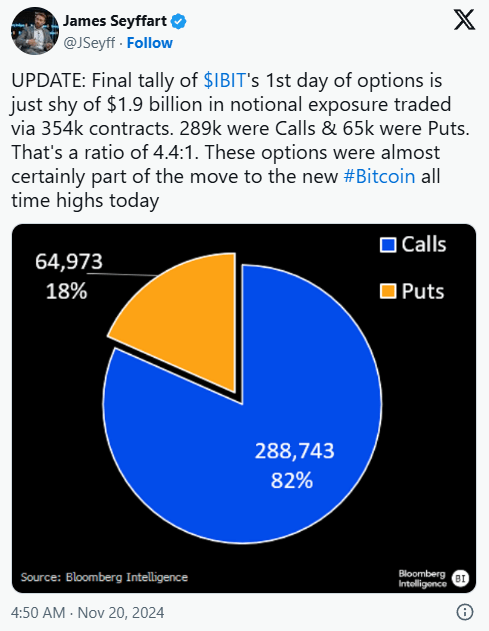

Bloomberg ETF analyst James Seyffar said that on the first day of trading, the total value of options reached nearly $ 1.9 billion, with 289,000 calls and 65,000 puts, a ratio of 4.4: 1, contributing to the record price increase of Bitcoin.

Buying options allows investors to profit if the price of Bitcoin increases. Joe Constori of Theya and Bitcoin Layer believes the market is optimistic about Bitcoin price surpassing $100,000 by the end of the year.

Bloomberg analyst Eric Balchunas said the $1.9 billion in first-day trading was unprecedented, far surpassing BITO's $363 million over four years, with a contract position limit of just 25,000.

Increased interest from organizations

The launch of BlackRock’s IBIT options marks a surge in institutional interest in Bitcoin, with options allowing investors to access new investment avenues and manage risk without owning the underlying asset.

Since the SEC approved Bitcoin ETFs in January, the market has grown rapidly, especially under the leadership of BlackRock. By the end of October, IBIT had reached $30 billion in net assets in 293 days, and $40 billion in just 211 days, showing a surge in interest in cryptocurrency investing.