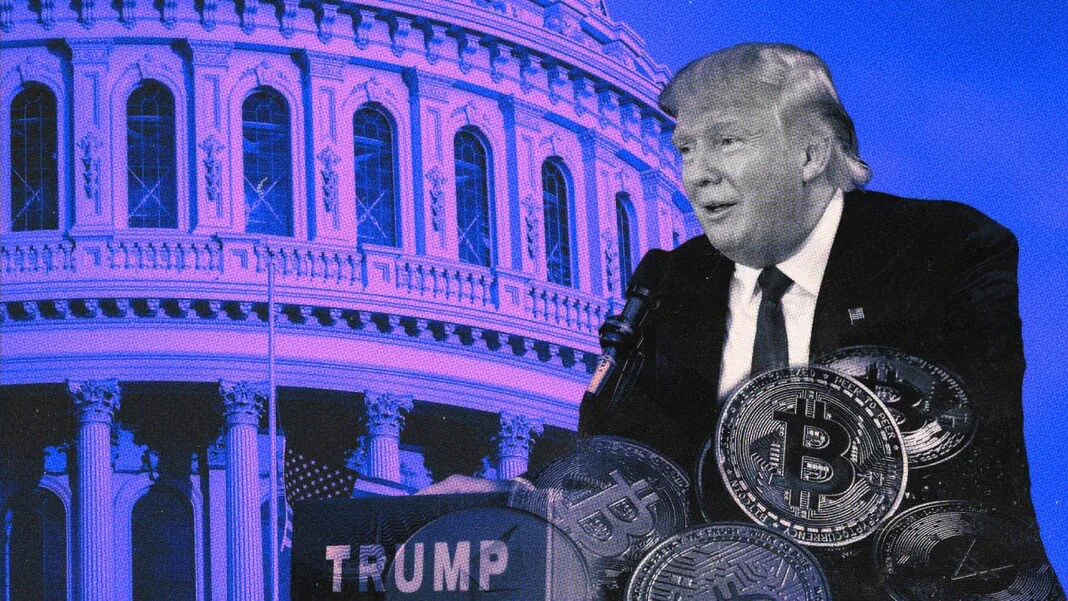

BlackRock: Trump's Victory Brings Optimism to Bitcoin

With the $10 trillion asset manager emerging as a key driver of the asset’s continued performance this year, BlackRock recently said that Trump’s 2024 election victory brings “a renewed sense of optimism” for Bitcoin and a strategic reserve. The firm noted that his arrival could usher in a new era of regulatory clarity for the asset class in the United States.

The past two years have seen anything but clear regulation for the domestic industry. The U.S. Securities and Exchange Commission (SEC) has taken an enforcement-driven approach that has resulted in numerous lawsuits. However, BlackRock recently noted that this could change with Trump back in the White House.

BlackRock Expects Big Changes in Bitcoin After Trump’s Re-Election

Over the course of the year, Bitcoin has seen a major shift taking place in the United States. With the approval of a BTC ETF in January, the market has opened up exponentially as the leading cryptocurrency. Furthermore, it has seen a wave of institutional investment as it becomes more relevant on a more mainstream stage than ever before.

However, that is only expected to continue to increase in the coming years. According to BlackRock, Trump’s victory has brought “a renewed sense of optimism” about both Bitcoin and the potential for strategic reserves in the United States. The asset manager noted that the latter was a key campaign promise from the 45th president’s re-election administration.

“There is a renewed sense of optimism that regulatory clarity for Bitcoin and digital assets in general may emerge after the US election,” they said in a recent note. “President-elect Donald Trump’s campaign pledge to maintain a strategic Bitcoin reserve.”

There are many who believe such a reserve could soon become a reality. In a post on X (formerly Twitter), U.S. Senator Cynthia Lummis shared her belief that a strategic Bitcoin reserve could be realized within Trump’s first 100 days. The move could have unprecedented potential and represent a landmark shift in the president’s perception of cryptocurrencies as an asset class.