Bitcoin to Gold Ratio Hits New Record as BTC Sets New High

The Bitcoin/gold ratio hit an all-time high on December 16, with 1 BTC equivalent to 40 ounces of gold as Bitcoin's price surpassed $106,000 , while spot gold was around $2,650 an ounce.

Not the end yet?

Brandt predicts the BTC/gold ratio will continue to rise, with the next target being 89 ounces of gold to buy 1 BTC.

Brandt and the crypto community are hoping Bitcoin will capitalize on the $15 trillion gold market. At $104,690 and a $2.1 trillion market cap, Bitcoin is seen as having plenty of room to grow, according to Cathie Wood, founder of ARK Invest.

Wood’s comments come shortly after US Federal Reserve Chairman Jerome Powell called Bitcoin a digital version of gold as BTC broke the $100,000 price mark on December 5.

Bitcoin to Pass Its Last Difficulty Adjustment in 2024

The new record for the Bitcoin-to-gold ratio comes at a time when mining new Bitcoins is becoming increasingly difficult.

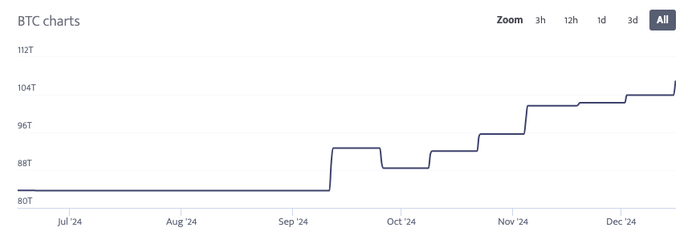

On December 15, Bitcoin mining difficulty — a measure of how difficult it is to find the correct hash for each block on the Bitcoin blockchain — rose to a new record high of above 105 trillion, according to data from CoinWarz.

Adjusted every 2,016 blocks or approximately 14 days, the next Bitcoin mining difficulty adjustment is scheduled to take place on January 1, 2025.