Bitcoin Set for ‘Major Move’ as Bollinger Bands Tighten to New Low

Bitcoin's record low volatility signals a major price move is coming.

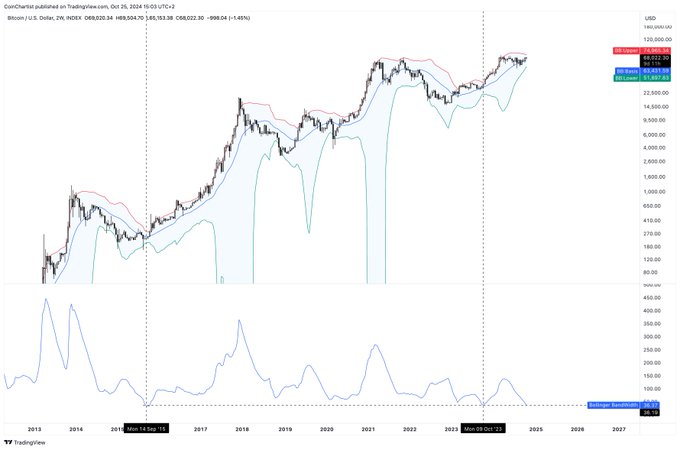

Bitcoin’s Bollinger Bands are currently in a “squeeze” – also known as a Bollinger Squeeze – indicating a period of low volatility, which often precedes a strong breakout.

“Big move coming,” said analyst Tony Severino , who said Bitcoin’s Bollinger Bands are in their three tightest periods on a two-week time frame .

In the past, these squeezes have led to significant price volatility.

In April 2016 and July 2023 , tightening Bollinger bands led to strong price rallies.

However, volatility trends can be up or down. For example, the 2018 squeeze caused a sharp decline.

History shows that after each squeeze, Bitcoin has increased in price seven out of nine times.

Bitcoin Whales Accumulate at Record High

According to Crypto Briefing , Bitcoin whales have accumulated 670,000 BTC , the highest level ever recorded, which often accompanies strong price surges.

While this is a positive sign, Bitcoin price is still fluctuating around the current level, showing no immediate momentum for a breakout.

If Bitcoin doesn't hit a new high before the end of November , the bull run could be in trouble.

Recently, Bitcoin price dropped below $65,500 following news of a criminal investigation into Tether , the largest stablecoin.

The Wall Street Journal reported that Tether is under investigation for drug trafficking and terrorism financing. Tether CEO Paolo Ardoino denied the allegations, calling them “completely false.”

Impact of geopolitical tensions

Tensions in the Middle East , particularly between Israel and Iran , also contributed to market volatility.

On October 26 , Israel attacked Iran in response to an Iranian missile launch on October 1. Bitcoin, which is sensitive to geopolitical volatility, often drops quickly and then corrects. Currently, Bitcoin is trading around $66,800 , down 1.3% over the past 24 hours , according to CoinGecko .