Bitcoin Seeks Recovery, Altcoins Struggle in Red

The entire cryptocurrency market has seen many adjustments in the past few days, Bitcoin's inability to regain the $100,000 mark has negatively affected the affected Altcoins.

Bitcoin Seeks Recovery

Bitcoin is struggling to find green, with a 3.7% drop over the past seven days that has dragged the price down to the $94,000 region. At the time of writing, the price is hovering at $94,313, up 0.3% over the past 24 hours.

Over the past month, Bitcoin bulls have shown signs of fatigue as they failed to sustain the $100,000 mark. The price went from a high of $108,135 recorded on December 17, 2024 to a low of $91,925 on January 9, 2025.

Bitcoin's market capitalization has also dropped sharply over the past 30 days, from a high of $2.1 trillion to $1.8 trillion at the time of writing.

However, investors seem to remain optimistic about 2025 but are also cautious about taking long/short positions at this time as the Asian New Year approaches, which is when Asian investors often take profits to shop for the upcoming New Year.

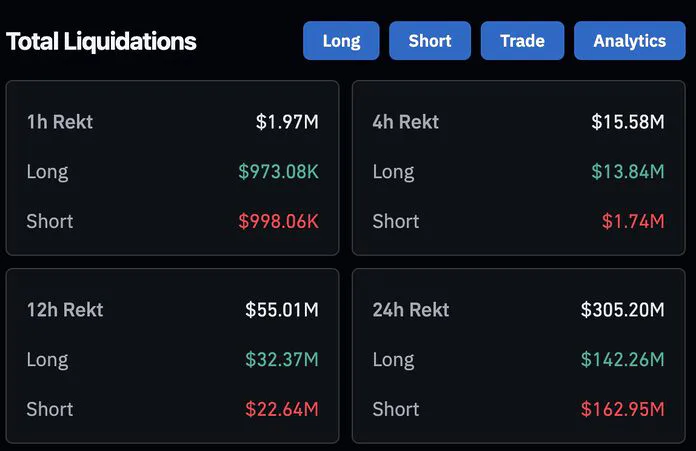

According to CoinClass, the value of liquidations on exchanges has remained high in recent days . As of 24 hours, $305 million was liquidated, with long and short positions split evenly, at $142 million and $162 million respectively, indicating market unease.

Many altcoins fell sharply

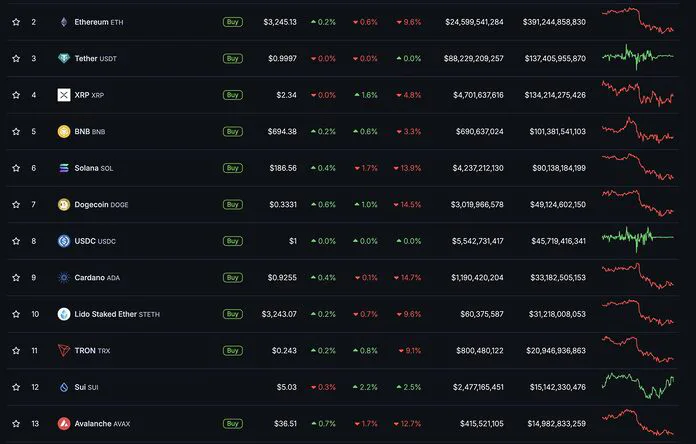

The altcoin market has shown mixed performance. While Ethereum has plummeted nearly 10% in the past seven days to trade at $3,245, altcoins like XRP, Solana, DOGE, ADA have suffered even more.

Over the past week, XRP is down 4.8%, SOL is down 13.9%, DOGE is down 14.5%, and ADA is down 14.7%.

In the top 15, only SUI is the cryptocurrency with positive growth performance.

SUI rose from $3.51 on December 20, 2024 to an all-time high of $5.35 on January 4, 2025. In just one year, the cryptocurrency has increased by 456%, according to Coingecko.

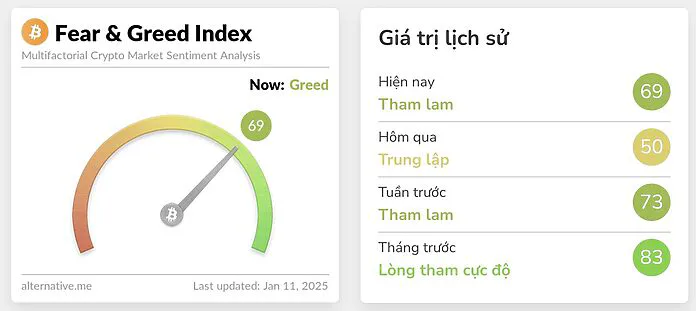

As the market corrects, the Crypto Fear and Greed Index also sees a lot of changes.

The Crypto Fear and Greed Index can show investors current and historical market sentiment. According to Alternative, the index ranges from 0 (Extreme Fear) to 100 (Extreme Greed), reflecting the sentiment of the crypto market. Low values signal oversold conditions, while high values warn of a possible market correction.