Bitcoin ( BTC ) recovered to $96,000 on Bitstamp but was still down 1.5% on the day, after hitting a low of $92,000 in early December. According to analyst Rekt Capital , BTC has fallen 15% from its previous peak due to a series of support losses.

Rekt Capital believes that Bitcoin is experiencing a similar price correction in 2021, which usually lasts for several weeks. This is the first correction in a bull cycle, considered an optimal accumulation opportunity with strong resilience.

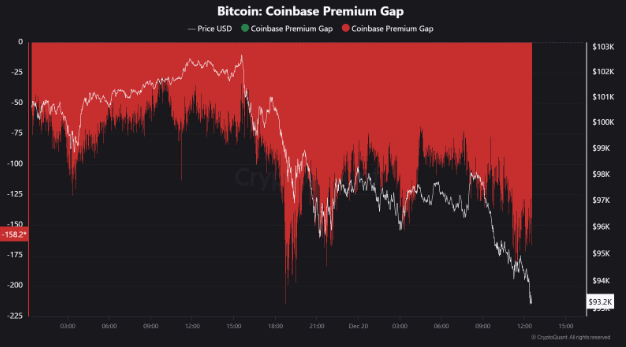

According to CoinGlass , $1.4 billion in crypto was liquidated in the past 24 hours. JA Maartun of CryptoQuant believes that the selling pressure mainly came from Coinbase, with a negative premium between BTC/USD on Coinbase and BTC/USDT on Binance.

BQYoutube from CryptoQuant recommends: “ When Coinbase Premium is negative, stay out and wait for a signal. When Premium is positive, get back in and hold .”

Bitcoin, Cryptocurrencies Welcome Lower PCE Inflation

The US PCE data , the Fed's preferred inflation gauge, came in at 2.4%, below expectations of 2.5%, bringing some relief to the market. However, The Kobeissi Letter warned that inflation is rising again , predicting a period of volatility ahead.

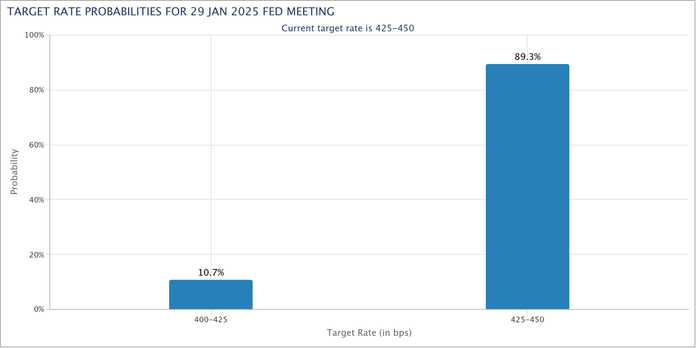

The results had a modest impact on market expectations for future Fed policy. Estimates from the CME Group's FedWatch Tool put the odds of another rate cut at the January meeting of the Federal Open Market Committee, or FOMC, at 10.7%, down from 8.6% the day before.