Bitcoin is now bigger than Netflix and Tesla combined

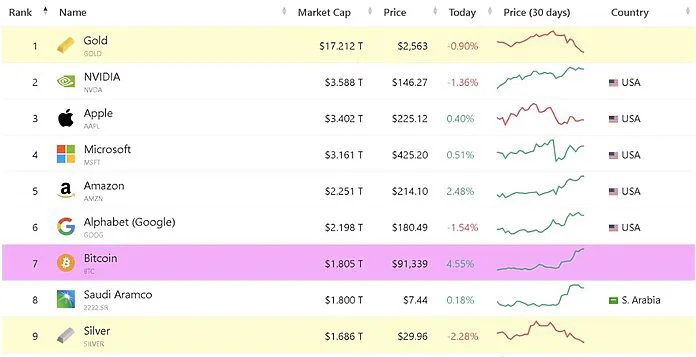

Over the years, Bitcoin has shown great potential, constantly rising in price to reach new highs. However, this year, BTC surpassed a major milestone, the price of $90,000, making the token the seventh largest asset in the world, surpassing Saudi Arabia's Aramco Oil Company and other notable assets such as Silver.

Bitcoin is the 7th largest asset in the world

A recent post by Kobeissi Letter provided a fascinating analysis. The portal outlined how Bi

“To put that into perspective, Bitcoin is now bigger than Tesla and Netflix combined. In the same week, Bitcoin surpassed the value of both Silver and Saudi Aramco. It is now just 11% away from becoming a $2 trillion asset for the first time in history. Truly historic.tcoin has now become the 7th largest asset in the world, surpassing Saudi Arabia’s Aramco oil and silver. To put the development in perspective, the portal shared how Bitcoin is now larger than Tesla and Netflix combined, with its value peaking at a rapid pace. The token is 11% away from becoming a $2 trillion asset, a development that is unique in historical time.

“To put that into perspective, Bitcoin is now bigger than Tesla and Netflix combined. In the same week, Bitcoin surpassed the value of both Silver and Saudi Aramco. It is now just 11% away from becoming a $2 trillion asset for the first time in history. Truly historic.The portal then shared comparisons that illustrate Bitcoin’s power and dominance in mainstream finance. Kobeissi Letter stated that Bitcoin is exactly half the size of Nvidia, which implies that if BTC reaches $185,000, it will be larger than all the top public companies in the world.

“Bitcoin is also only half the size of Nvidia, $NVDA, the largest public company in the world today. This means Bitcoin would have to rise to ~$185,000 to become larger than all public companies. At the current rate, we could see Bitcoin hit $100,000+ this week.”

Why is the coin price increasing so fast?

The portal was quick to outline the reasons for Bitcoin’s surge to $90,000. The platform labeled the US election as the main driver behind the BTC boom. Trump’s pro-crypto stance has rekindled hope in the hearts of crypto enthusiasts, prompting them to hold onto Bitcoin in the hope of better returns.

“So what’s going on? Since Election Day, Bitcoin has seen record levels of inflows as investors flock to the market. In the past week alone, we’ve seen $145 billion in inflows, not counting today. Pro-crypto policies are expected to help drive crypto adoption. Bitcoin is the BIG winner in the 2024 election and it’s not even close. So far, 50 of the 58 candidates for US Congress backed by pro-crypto PACs have won their races. This means crypto is likely to see more favorable regulatory policies and laws.”

Additionally, Bitcoin ETFs have also played a major role in pushing BTC prices skyrocketing. The token is now heading towards its next milestone, the coveted price of $100,000.

According to CoinCodex, BTC price could hit $107,000 by the end of this month if momentum supports the token’s trajectory.

“According to our current BTC price prediction, Bitcoin price is predicted to increase by 20.32% and reach $107,910 by December 14, 2024. According to our technical indicators, the current sentiment is Bullish while the Fear & Greed Index is showing 88 (Extreme Greed). Bitcoin has recorded 18/30 (60%) green days with a price movement of 8.41% over the past 30 days. Based on the Bitcoin forecast, now is a good time to buy BTC.”tcoin has now become the 7th largest asset in the world, surpassing Saudi Arabia’s Aramco oil and silver. To put the development in perspective, the portal shared how Bitcoin is now larger than Tesla and Netflix combined, with its value peaking at a rapid pace. The token is 11% away from becoming a $2 trillion asset, a development that is unique in historical time.