Bitcoin ETF Inflows Hit $223 Million as Institutional Demand Rebounds

Bitcoin ETF Inflows Hit $223 Million as Whales Step Up Accumulation, Pushing BTC Price Back to $100,000

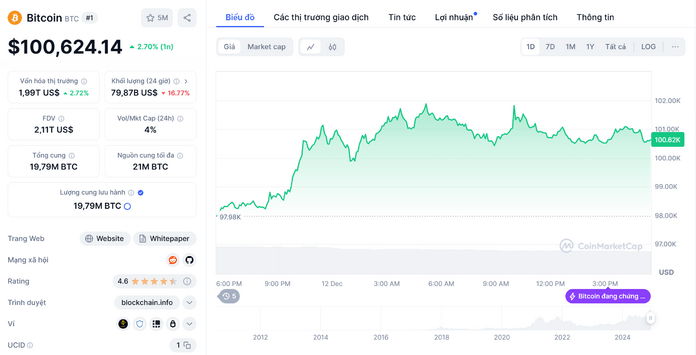

Bitcoin (BTC) has returned to $100,000 today after experiencing a strong rally over the past week. Experts shared that after BTC recovered the important support zone between $94,300 and $96,600, the asset is retesting its previous ATH between $101,219 and $101,998.

However, at the time of writing, Bitcoin has slightly declined and is trading at $100,624, seeing a 2.7% increase over the past 24 hours.

Additionally, Bitcoin Futures open interest (OI) increased by 6% to around $62.8 billion. With the recent large liquidations in the leveraged market, Bitcoin funding rates have dropped significantly below recent normal levels.

Bitcoin Whales Keep Accumulating

Analysts believe that this Bitcoin recovery has been significantly impacted by increased demand from institutional investors, leading to a continued decline in the supply of BTC on centralized exchanges.

As more institutions adopt Bitcoin, the market potential will continue to grow. According to data from Cryptoquant , Bitcoin has attracted about $80 billion from long-term investors each month over the past year.

Notably, recent Bitcoin inflows have significantly eclipsed the inflows over the past 15 years. Whale investors have been steadily accumulating Bitcoin in anticipation of the US approving a strategic BTC reserve.

According to the latest market data, US spot Bitcoin ETFs recorded net inflows of around $223 million on Wednesday, thus bringing the cumulative net inflow to around $34.58 billion.