Amazon Shareholders Ask the Company to Consider Adding Bitcoin to Its Treasury

Amazon shareholders are asking the company to consider adding Bitcoin to its balance sheet as a way to hedge against inflation. This follows a trend of companies, including Microsoft and Tesla, exploring Bitcoin as an asset.

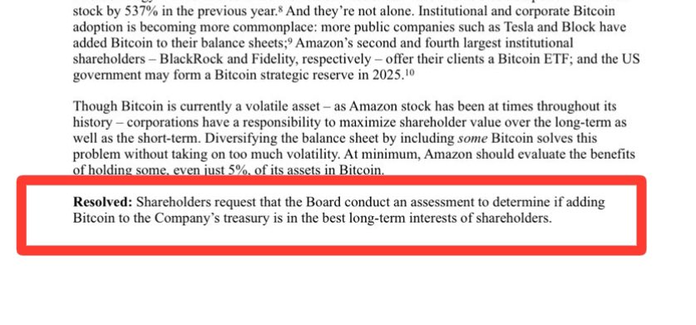

Amazon shareholders have proposed that the company consider adding Bitcoin to its balance sheet, following the trend of major companies like Microsoft and Tesla , to protect assets from inflation and increase shareholder returns.

Why Bitcoin for Amazon?

Amazon shareholders have suggested the company consider adding Bitcoin to its asset reserves to protect profits from inflation and achieve higher returns, citing Bitcoin's outperformance of bonds.

Meanwhile, former Binance CEO Changpeng Zhao suggested that Amazon should accept Bitcoin as a payment method.

Companies like MicroStrategy , which holds a lot of Bitcoin, have seen their stock prices rise. Other companies like Tesla and Block (formerly Square) have also added Bitcoin to their balance sheets. The proposal suggests Amazon could do the same to increase shareholder value.

Amazon shareholders have proposed that the company begin holding 5% of its assets in Bitcoin to capitalize on its long-term value and protect against inflation, echoing a trend among major companies like Microsoft that are considering Bitcoin. The adoption of Bitcoin by major corporations could shape the way corporate assets are managed in the future. Amazon has not made a final decision.